Home » Small Business Loans

Small Business Loans

Need funds urgently for growing your business, for consolidating your debt, for funding your child’s education or for an upcoming medical emergency? Worry no more, presenting Small Business Loans from IndoStar Capital Finance, a unique product that helps you unlock the power of your property (residential or commercial). Now leverage the hidden potential of your property by using it as a collateral and meeting your financial needs.

Benefits of Small Business Loans:

- Ease of application – An individual can apply for small business loans not only against a constructed/ready property (commercial or residential) but also against a plot of land.

- Multipurpose – Small business loans can be used for a variety of purposes ranging from business requirements, higher education, medical emergency, child’s marriage, etc.

- Competitive interest rates – Small business loans typically have lower interest rates compared to unsecured loans. This makes them an attractive option for borrowers looking for affordable financing.

- Supported by the government – Such loans have been supported by the government of India under its various schemes and initiatives to promote financial inclusion and boost access to credit.

- Flexibility for availing loan – Offers financing to individuals with limited credit history or smaller properties, catering to the needs of micro entrepreneurs and individuals who require smaller loan amounts.

Purposes for which Small Business Loans can be used:

Working capital

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

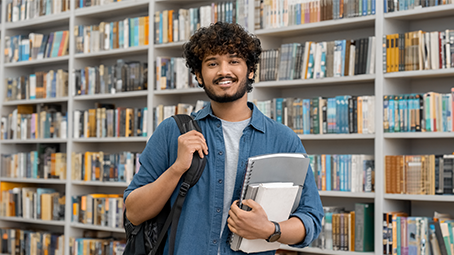

Higher education

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Child’s marriage

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Medical expenses

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Consolidation of obligations

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Features

- Customised loans for small businessmen

- Lower interest rates as compared to unsecured loans

- These loans can be used for varied/multiple purposes

- Part of government’s financial inclusion initiative

- Tenure from 1 year to 7 years

Eligibility norms

Any Indian resident or business entity

Individual need to be at least 21 years old

Identity and Address Proof:

- PAN Card.

- Aadhar Card.

- Passport.

- Voter ID Card.

- Driving License.

- Job card signed by NREGA.

- Letter issued by National Population Register (must contain name and address).

In case the abovementioned documents do not contain the current address, a certified copy of any of the following documents to be obtained:

- Utility bill which is not more than two months old of any service provider (electricity, telephone, post-paid mobile phone, piped gas, water bill).

- Property or municipal tax receipt.

- Pension or family pension payment orders (PPOs) issued to retired employees by Government Departments or Public Sector Undertakings, if they contain the address;

- Letter of allotment of accommodation from employer issued by State Government or Central Government Departments, statutory or regulatory bodies, public sector undertakings, scheduled commercial banks, financial institutions and listed companies and leave and license agreements with such employers allotting official accommodation.

The documents listed above are indicative and may vary based on the customer type.

- Udyam Registration certificate.

- Shop and Establishment Certificate.

- Sales and income tax returns.

- CST/VAT/GST certificate (provisional / final).

- Certificate/registration document issued by Sales Tax/Service Tax/Professional Tax authorities.

- IEC (Importer Exporter Code) issued to the proprietary concern by the office of DGFT/ License/certificate of practice issued in the name of the proprietary concern by any professional body incorporated under a statute.

- Complete Income Tax Return duly authenticated/acknowledged by the Income Tax authorities.

- Utility bills such as electricity, water, and landline telephone bills.

The documents listed above are indicative and may vary based on the customer type.

Identity and Address Proof of beneficial owner, managers, officers or employees holding an attorney to transact on behalf of the Partnership Firm:

- PAN Card.

- Aadhar Card.

- Passport.

- Voter ID Card.

- Driving License.

- Job card signed by NREGA.

- Letter issued by National Population Register (must contain name and address).

The documents listed above are indicative and may vary based on the customer type.

- Registration certificate.

- Partnership deed

- Permanent Account Number of the Partnership Firm.

- KYC Template / information as prescribed by the Reserve Bank of India for uploading data with Central KYC Record Registry.

- Such other documents as may be prescribed from time to time.

The documents listed above are indicative and may vary based on the customer type.

- Document showing name of the person authorized to act on behalf of the entity;

- For documents to be obtained from person holding attorney to transact on behalf of the Such documents as may be required by the Company to establish the legal existence of such an entity.

- KYC Template / information as prescribed by the Reserve Bank of India for uploading data with Central KYC Record Registry.

- Such other documents as may be prescribed from time to time.

- entity – Please refer to documents to be obtained from “Individual Customers”.

The documents listed above are indicative and may vary based on the customer type.

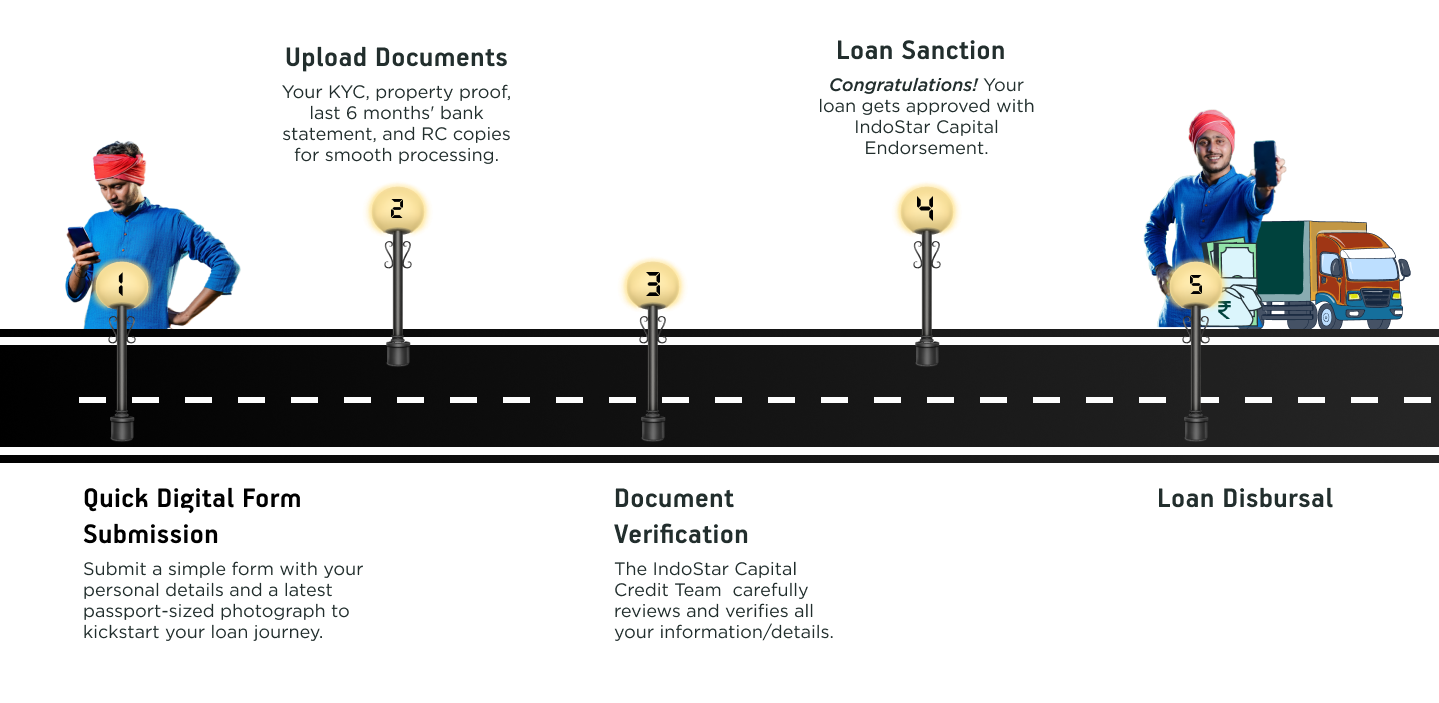

How To Apply For Loan

Interest rates, Charges and Fees

Your small business loan interest rate determines your EMI payments towards the loan repayment. At IndoStar, we offer loans at competitive interest rates, along with a flexible repayment tenure. Further, interest rates may vary for different borrowers depending on various eligibility factors like income, CIBIL score, loan amount, loan tenure, repayment capacity, financial history, and many more.

The interest rate for a small business loan at IndoStar may range from 10% to 36% depending on eligibility calculations.

Fees structure can be taken from the current page: Interest Rates and Charges Policy

EMI Calculator*

Introducing Insurance services for you and your vehicle/s in partnership with

*The loan amount depends upon various factors which may differ on a case-to-case basis.