Home » About Us

About IndoStar Capital Finance Limited

IndoStar Capital Finance Limited (“ICFL”) is a Non-Banking Finance Company (“NBFC”) registered with Reserve Bank of India categorized as middle layered NBFC. With Brookfield & Everstone as co-promoters, IndoStar Capital Finance Limited is professionally managed and institutionally owned entity dealing in comprehensive range of financial products like Commercial Vehicle, Construction Equipment, Farm Equipment, Car/MUV, Insurance and Micro Lap -(Small ticket business loans) . IndoStar Capital Finance Limited offers end-to-end lending, financing, credit solutions and caters to the aspirations of the growing consumer base in India, and deliver greater value to our Stakeholder(s). Our assets under management exceed INR 8000 crores and our extensive network of over 500+ branches nationwide serves our growing base of 1 lakh+ customers.

IndoStar Capital Finance Limited focuses on Small time retail customers mainly in Tier 2 , Tier 3 and Tier 4 towns, offering them tailor made solutions to earn their livelihood with competitive pricing & transparent terms.

IndoStar Capital Finance Limited has two wholly owned subsidiary i.e. IndoStar Home Finance Private Limited, dealing in affordable Home Financing solutions and IndoStar Asset Advisory Private Limited.

“Partner with our customers on their journey to financial success.”

“To be a major financial service provider to our target customers through empowered happy employees, and deliver a competitive shareholder return while maintaining highest ethical behaviour standards.”

Our Values

At IndoStar Capital Finance Ltd, our values serve as the guiding principles that shape our culture and define how we operate as a team. These values reflect who we are, what we believe in, and how we strive to make a positive impact on our clients, employees and the world around us. They inspire us to push boundaries, foster innovation and uphold the highest standards of integrity in everything we do.

We R.E.A.C.H for greater heights by following these core values

RESILIENCE

Ability to withstand and bounce back from difficult, adverse or challenging situations.

ETHICS

Understanding the essence of Code of Conduct and governing business principles.

ACCOUNTABILITY

Responsibility and ownership to the committed actions, decisions and the outcomes of those actions.

COLLABORATION

Work as a team towards a common goal, through shared knowledge, to achieve a desired outcome.

HIGH-PERFORMANCE

Achieving exceptional results by exceeding expectations, and consistent performance.

These values are the foundation of our company, guiding our decisions, actions and interactions. They reflect our commitment to excellence, customer satisfaction, innovation, collaboration, integrity, social responsibility and continuous growth. By embodying these values, we aim to build lasting relationships and create a positive impact in the world.

Meet Our Leaders

Naina Krishna Murthy

Ms. Naina Krishna Murthy is the Chairperson and a Non-Executive Independent Director of IndoStar Capital Finance Limited. She has more than two decades of experience in the legal sector.

Naina Krishna Murthy

Bobby Parikh

Mr. Bobby Parikh is the Non-Executive Non-Independent Director of IndoStar Capital Finance Limited. He has nearly three decades of experience in financial services industry/reorganisations.

Bobby Parikh

Hemant Kaul

Mr. Hemant Kaul is a Non-Executive Independent Director of IndoStar Capital Finance Limited. He has vast experience as an independent management consultant, having worked with private equity firms to evaluate investments in the financial sector.

Hemant Kaul

Sujatha Mohan

Ms. Sujatha Mohan is a Non-Executive Independent Director of IndoStar Capital Finance Limited. Ms. Sujatha Mohan has over 30 years of experience across the Banking and IT industries. Ms. Mohan, a Wharton Alumnus, is the founder of Pharus Consulting LLP, a firm that supports organizations in the BFSI sector by offering a practitioner’s view of digital, business and execution strategies.

Sujatha Mohan

Aditya Joshi

Mr. Aditya Joshi is a Non-Executive Non-Independent Director of IndoStar Capital Finance Limited. He is also a Managing Partner in Brookfield’s Private Equity Group and heads the private equity business for Brookfield India and the Middle-East. Mr. Joshi has conceptualised Brookfield’s private equity strategy for the India and Middle-East region, including nurturing and developing a high quality team, building a robust sourcing engine, leading deal-execution and ongoing portfolio monitoring.

Aditya Joshi

Dhanpal Jhaveri

Mr. Dhanpal Jhaveri is a Non–Executive Non-Independent Director of IndoStar Capital Finance Limited. He has over two decades of experience in investments, strategy, M&A and investment banking. Currently, he is a Managing Partner at the Everstone Group.

Dhanpal Jhaveri

Devdutt Marathe

- Director

Mr. Devdutt Marathe is a Non-Executive Non-Independent Director of IndoStar Capital Finance Limited. He is an investment professional with over thirteen years of experience in the Private Equity space. He is currently a Senior VP at Brookfield Asset Management focused on the Private Equity business in the India / Middle East region.

Devdutt Marathe

Randhir Singh

Mr. Randhir Singh is the Managing Director designated as Executive Vice Chairman at IndoStar Capital Finance Limited. He is a seasoned financial leader with 30+ years of experience in MSME/Corporate/FIG Lending, Structured Finance, Debt Capital Markets, Treasury, Sales and Trading, FX and Interest Rate derivatives, Risk Management and Banking Operations.

Randhir Singh

Randhir Singh – Managing Director and Executive Vice Chairman

Mr. Randhir Singh is the Managing Director designated as Executive Vice Chairman at IndoStar Capital Finance Limited. He is a seasoned financial leader with 30+ years of experience in MSME/Corporate/FIG Lending, Structured Finance, Debt Capital Markets, Treasury, Sales and Trading, FX and Interest Rate derivatives, Risk Management and Banking Operations.

Randhir Singh – Managing Director and Executive Vice Chairman

Jayesh Jain – Chief Financial Officer

Mr. Jayesh Jain is the Chief Financial Officer at IndoStar Capital Finance Limited. With over 24 years of experience in the Housing Finance and NBFC sectors, he has held key leadership roles, responsible for financial strategy, business reengineering, cost optimization, IPO initiatives, M&A, debt and equity raising, regulatory compliance, internal audit, financial reporting, taxation, technology integration, and finance transformation.

Jayesh Jain – Chief Financial Officer

Nitin Gyanchandani – Chief Risk Officer

Mr. Nitin Gyanchandani is a qualified Chartered Accountant from Institute of Chartered Accountant of India. He has over 18 years of experience in the Banking and Financial Services and has a rich experience in managing Corporate Banking and Credit Underwriting & Analysis

Nitin Gyanchandani – Chief Risk Officer

Rashmita Prajapati – Chief Compliance Officer

Mrs. Rashmita Prajapati is the Chief Compliance Officer and has been associated with the Company since August 2023. She is a qualified Company Secretary from Institute of Company Secretaries of India. She also holds a Bachelor‘s degree in Commerce and also in Law from University of Mumbai.

Rashmita Prajapati – Chief Compliance Officer

Shikha Jain – Company Secretary

Ms. Shikha Jain is a Commerce Graduate and a qualified Company Secretary from the Institute of Company Secretaries of India. She has experience in working under secretarial department of Public and Private Limited Companies.

Shikha Jain – Company Secretary

Our Initiatives

Promoting Education

AVASARA ACADEMY

Through Avasara Academy, IndoStar Capital Finance Ltd has contributed towards providing education to adolescent girls from economically weaker sections of the society. The academy is equipping young women with essential…

Empowering Women

POPULATION FIRST

This initiative promotes the economic empowerment of women through vermi-composting. Learning this skill equips members of villages with a lifelong method of earning money while living a healthier life…

Sanitation

Centre for Environmental Research and Education (CERE)

Under the Water Conservation and Rainwater Harvesting Project, conducted at the Police HQ in Naigaon, IndoStar Capital Finance Ltd contributed towards the augmentation of water for the police family…

Board of Directors

Naina Krishna Murthy

Ms. Naina Krishna Murthy is the Chairperson and a Non-Executive Independent Director of IndoStar Capital Finance Limited. She has more than two decades of experience in the legal sector. She is the Founder and Managing Partner of Krishnamurthy & Company. She is also a trusted legal advisor to numerous corporations. Over the years, Ms. Murthy has built a strong reputation in corporate commercial law, specifically in the areas of mergers and acquisitions, joint ventures, collaborations and PE/VC investments. She was recognised by India Business Law Journal as ‘A List’ of India’s top 100 lawyers in 2018, 2017 and 2016. She holds a degree in Law, with a B.A. and LLB (Hons) from National Law School, Bangalore.

Bobby Parikh

Mr. Bobby Parikh is the Non-Executive Non-Independent Director of IndoStar Capital Finance Limited. He has nearly three decades of experience in financial services industry/reorganisations. Mr. Parikh’s area of focus is providing tax and regulatory advice in relation to transactions and other forms of business reorganizations. He has founded Bobby Parikh Associates, a boutique firm focused on providing strategic tax and regulatory advisory services. Mr. Parikh is a qualified Chartered Accountant from the Institute of Chartered Accountants of India and holds a Bachelor of Commerce degree from the University of Mumbai.

Hemant Kaul

Mr. Hemant Kaul is a Non-Executive Independent Director of IndoStar Capital Finance Limited. He has vast experience as an independent management consultant, having worked with private equity firms to evaluate investments in the financial sector. Earlier, Mr. Kaul has also been the MD & CEO of Bajaj Allianz General Insurance Co Ltd. and the Executive Director of Axis Bank. Mr. Kaul holds a Bachelor’s degree in Science and a Master’s degree in Business Administration from Rajasthan University.

Sujatha Mohan

Ms. Sujatha Mohan is a Non-Executive Independent Director of IndoStar Capital Finance Limited. Ms. Sujatha Mohan has over 30 years of experience across the Banking and IT industries. Ms. Mohan, a Wharton Alumnus, is the founder of Pharus Consulting LLP, a firm that supports organizations in the BFSI sector by offering a practitioner’s view of digital, business and execution strategies. She has been recognized for leading strategic and transformative initiatives across different organizations. Prior to this, Ms. Mohan was associated with HDFC Bank Limited, FIS Global, RBL Bank Limited, Oracle Financial Software Services Ltd, ANZ Grindlays Bank and Stock Holding Corporation of India Limited where she held various leadership roles. Her areas of specialization include core banking, core modernization, API Strategy, Digital Transformation & Payments. Over her 30-year career, she has received numerous awards/recognitions including the Asian Banker Award (twice) for 2 projects executed under her leadership. She was also the recipient of the Payments Award by the Indian Banking Association for projects executed under her mentorship and the Women in Fintech Award in 2019 by Fintegrate Zone.

Aditya Joshi

Mr. Aditya Joshi is a Non-Executive Non-Independent Director of IndoStar Capital Finance Limited. He is also a Managing Partner in Brookfield's Private Equity Group and heads the private equity business for Brookfield India and the Middle-East. Mr. Joshi has conceptualised Brookfield's private equity strategy for the India and Middle-East region, including nurturing and developing a high quality team, building a robust sourcing engine, leading deal-execution and ongoing portfolio monitoring. Mr. Joshi joined Brookfield in March 2019. Prior to Brookfield, he was a Principal at Apax Partners in India, and led and participated in deals across healthcare, technology services, and financial services. Prior to Apax, he worked at The Blackstone Group in India, where he focused on investment opportunities primarily across technology services and business services. Prior to Blackstone, Mr. Joshi worked at Morgan Stanley in India, where he worked on fund raising and mergers and acquisitions across technology services, business services, telecom, amongst other industries. Mr. Joshi holds a Master of Business Administration degree from The Wharton School, University of Pennsylvania, a bachelor’s degree in accounting and finance from the University of Pune, and is a Chartered Accountant and member of The Institute of Chartered Accountants of India. Mr. Joshi is a member of FICCI’s National Committee on Private Equity for India.

Dhanpal Jhaveri

Mr. Dhanpal Jhaveri is a Non–Executive Non-Independent Director of IndoStar Capital Finance Limited. He has over two decades of experience in investments, strategy, M&A and investment banking. Currently, he is a Managing Partner at the Everstone Group. Prior to joining Everstone, Mr. Jhaveri worked as Director (Corporate Strategy) with Vedanta Resources Plc. His previous assignments include being the Head of Investment Banking at ICICI Securities and Partner for Corporate Finance at KPMG. Mr. Jhaveri holds a degree in Bachelor of Commerce from the University of Mumbai and an MBA from Babson College, USA.

Devdutt Marathe

Mr. Devdutt Marathe is a Non-Executive Non-Independent Director of IndoStar Capital Finance Limited. He is an investment professional with over thirteen years of experience in the Private Equity space. He is currently a Senior VP at Brookfield Asset Management focused on the Private Equity business in the India / Middle East region. Previously, Devdutt Marathe was a Principal at Apax Partners, where he led or participated in several transactions across financial services, healthcare and technology sectors. Devdutt Marathe holds B.Tech. and MS degrees in Electrical Engineering from IIT Madras and Caltech (USA) respectively, and a PGDM from IIM Ahmedabad.

Randhir Singh

Mr. Randhir Singh is the Managing Director designated as Executive Vice Chairman at IndoStar Capital Finance Limited. He is a seasoned financial leader with 30+ years of experience in MSME/Corporate/FIG Lending, Structured Finance, Debt Capital Markets, Treasury, Sales and Trading, FX and Interest Rate derivatives, Risk Management and Banking Operations. Randhir started his career with Citibank India in 1995 and worked there till 2007 in various roles. He then worked in Deutsche Bank as Managing Director and India Head of Financing between 2007 to 2016. He Subsequently worked in Edelweiss as CEO of Commercial Lending & Structured Finance from 2016 to 2018. Prior to joining IndoStar Capital Finance Limited, Randhir was Jt. CEO and Co-Founder of APAC Financial Services from 2018 to 2024.

Other Directorships of the Board of Directors

| Sr. no. | Name of the Director | Name of the Companies | |||

|---|---|---|---|---|---|

| 1 | Ms. Naina Krishna Murthy |

|

|||

| 2 | Mr. Dhanpal Jhaveri |

|

|||

| 3 | Mr. Devdutt Marathe |

Brookfield Asset Management |

|||

| 4 | Mr. Aditya Joshi |

Brookfield Asset Management |

|||

| 5 | Mr. Randhir Singh |

|

|||

| 6 | Mr. Hemant Kaul |

|

|||

| 7 | Ms. Sujatha Mohan |

8 |

Mr. Bobby Parikh |

|

|

Management

Randhir Singh

- Managing Director and Executive Vice Chairman

Mr. Randhir Singh is the Managing Director designated as Executive Vice Chairman at IndoStar Capital Finance Limited. Mr. Randhir Singh is a seasoned financial leader with 30+ years of experience in MSME/Corporate/FIG Lending, Structured Finance, Debt Capital Markets, Treasury, Sales and Trading, FX and Interest Rate derivatives, Risk Management and Banking Operations. Randhir started his career with Citibank India in 1995 and worked there till 2007 in various roles. He then worked in Deutsche Bank as Managing Director and India Head of Financing between 2007 to 2016. He Subsequently worked in Edelweiss as CEO of Commercial Lending & Structured Finance from 2016 to 2018. Prior to joining IndoStar Capital Finance Limited, Randhir was Jt. CEO and Co-Founder of APAC Financial Services from 2018 to 2024.

Karthikeyan Srinivasan

- Chief Executive Officer

Mr. Karthikeyan Srinivasan is the Chief Executive Officer and Whole time Director at IndoStar Capital Finance Limited. He is a qualified Cost Accountant from the Institute of Cost Accountants of India and holds an MBA in Finance & Marketing from Alagappa Institute of Management. He has over 25 years of experience in the areas of Retail Sales, Client Servicing, Credit / Portfolio Management and People Management in banking and financial services sector and has handled a wide range of financial products including Commercial Vehicle Loans, Construction Equipment Loan, Tractor Loans, Two-wheeler Loans etc. He has worked with various Banks like ICICI Bank Ltd, Kotak Mahindra Finance Limited, Cholamandalam Investment and Finance Company Ltd.

Jayesh Jain

- Chief Financial Officer

Mr. Jayesh Jain is the Chief Financial Officer at IndoStar Capital Finance Limited. With over 24 years of experience in the Housing Finance and NBFC sectors, he has held key leadership roles, responsible for financial strategy, business reengineering, cost optimization, IPO initiatives, M&A, debt and equity raising, regulatory compliance, internal audit, financial reporting, taxation, technology integration, and finance transformation. His expertise has been instrumental in driving business growth, operational efficiency, and profitability. Mr. Jain has worked with a wide range of organizations, including fintech companies, affordable and large housing finance firms, diversified NBFC, - GRUH Finance (a subsidiary of HDFC), PNB Housing Finance, Hero FinCorp, and Balance Hero India. Mr. Jain is a Chartered Accountant, held DISA, CISA and CISM certifications, and has attended management courses at Harvard, Wharton, and NUS. Throughout his career, Mr. Jain has received numerous accolades, including the Best CFO in the BFSI Sector at the ET Ascent National Awards 2022.

Nitin Gyanchandani

- Chief Risk Officer

Mr. Nitin Gyanchandani is a qualified Chartered Accountant from Institute of Chartered Accountant of India. He has over 18 years of experience in the Banking and Financial Services and has a rich experience in managing Corporate Banking and Credit Underwriting & analysis. He has also handled a wide range of financial products including commercial vehicle loans, construction equipment loan, healthcare and Auto Loans etc. He has played critical strategic roles and worked with cross-functional teams in laying down credit policies, developing new products, managed various Retail asset credit portfolios, managed all India Geographies, and trained underwriting teams. He has worked across Risk Management, Credit Underwriting & Analysis, Healthcare, and Auto. He was previously associated with premier financial organizations in the BFSI space including ICICI Bank Ltd and PricewaterhouseCoopers.

Rashmita Prajapati

- Chief Compliance Officer

Mrs. Rashmita Prajapati is the Chief Compliance Officer and has been associated with the Company since August 2023. She is a qualified Company Secretary from Institute of Company Secretaries of India. She holds a Bachelor‘s degree in Commerce and also in Law from the University of Mumbai. She has around 17 years of experience in handling SEBI compliances for Mutual Funds which includes regulatory reporting to the Board of Directors and regulators, interacting with the regulators, handling various product launches and ongoing compliances, listing related requirements (for Mutual Funds), training of employees, handling regulatory inspections and group related compliances. Rashmita Prajapati has previously worked with HDFC Asset Management Company Limited and HDFC Limited.

Shikha Jain

- Company Secretary

Ms. Shikha Jain is a Commerce Graduate and a qualified Company Secretary from the Institute of Company Secretaries of India. She has experience in working under secretarial department of Public and Private Limited Companies. She has worked with IIFL Wealth Finance Limited and Anand Rathi Group prior to joining IndoStar Capital Finance Ltd.

Committee Composition

We are a professionally managed and institutionally owned organization.

Risk Management Committee

Hemant Kaul

Chairman

Corporate Social Responsibility Committee

Naina Krishna Murthy

Chairperson

Stakeholders Relationship Committee

Dhanpal Jhaveri

Chairman

IT Strategy Committee

Sujatha Mohan

Chairperson

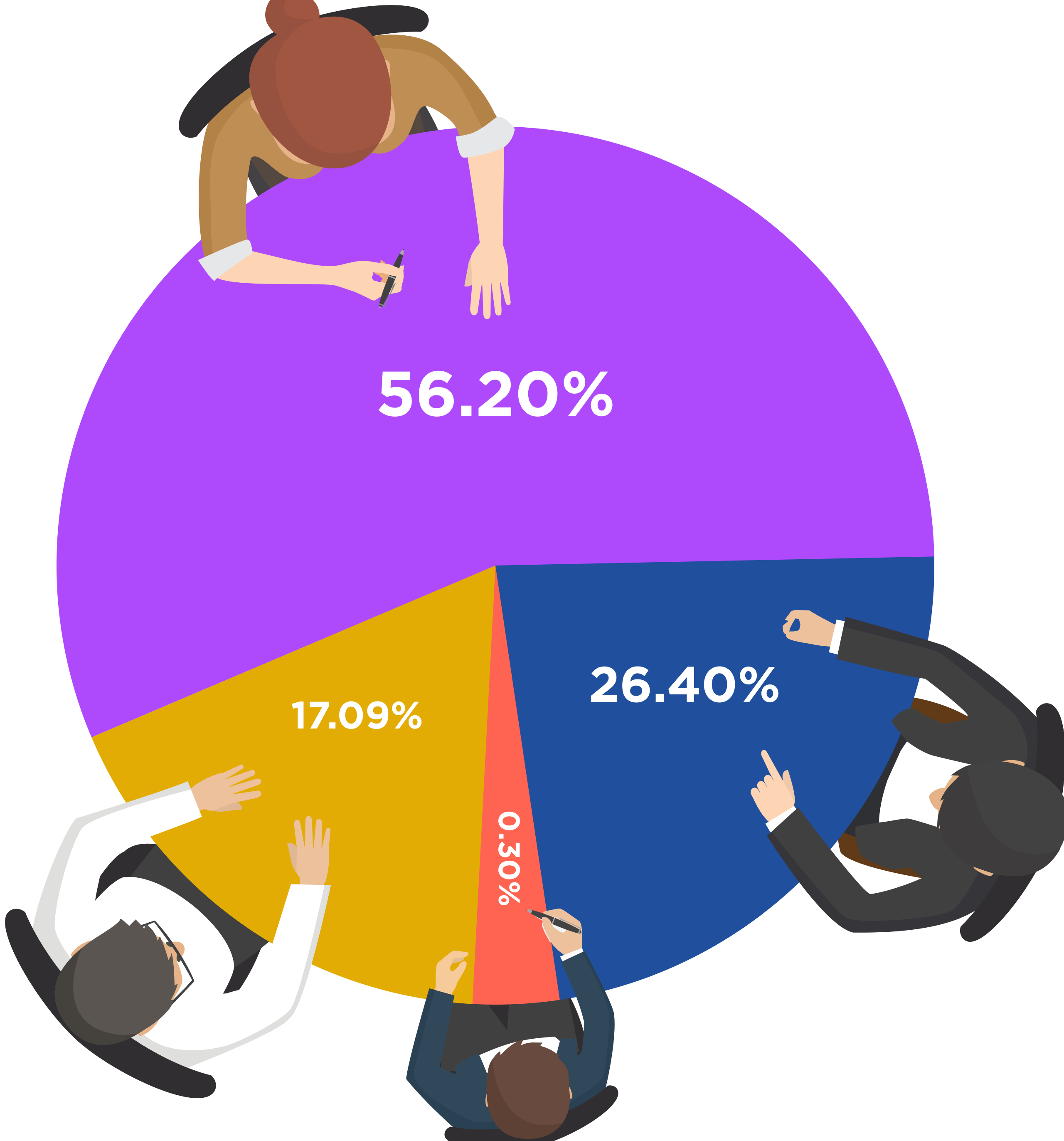

Note: Shareholding as on September 30, 2024

- BCP V Multiple Holdings Pte. Ltd. - Brookfield Group

- IndoStar Capital (Mauritius) - Everstone Group

- ECP III FVCI Pte. Ltd.- Everstone Group

- Public Shareholding

CSR at IndoStar

Corporate Social Responsibility is an integral part of our company culture. As a responsible corporation, we respect the interests of our stakeholders- shareholders, employees, customers, suppliers, teaming partners, and the wider community. Also, we actively seek opportunities to improve the environment and contribute to the well-being of the communities in which we operate. Our CSR initiative focuses mainly on the areas of sanitation, education, and women empowerment through skilling and development.

Promoting Education

Avasara Academy

Through Avasara Academy, IndoStar Capital Finance Ltd has contributed towards providing education to adolescent girls from economically weaker sections of the society. Based on the Cambridge curriculum, with an emphasis on leadership, entrepreneurship, and Indian studies, the Academy is equipping young women with essential tools to navigate life after school. Set up as a residential learning programme in Pune, the Academy continues to expand, introducing new facilities such as libraries and hostel accommodation. The students and their parents have changed their perception of receiving education; parents are now willing to send their kids to school to complete their schooling. The teaching techniques used here are more practical which prepares students for real-life scenarios. The students get an equal opportunity to actively involve themselves in sports as they have access to the Oxford Golf ground in Pune.

Empowering Women

Population First

This initiative promotes the economic empowerment of women through vermi-composting. Learning this skill equips members of villages with a lifelong method of earning money while living a healthier life. Women have become more confident and have the ability to contribute towards household incomes, while also being further committed to developing their marketing skills to increase sales. Children in schools are learning the importance of hygiene and have become advocates for the construction of kitchen gardens and soak pits in their community.

Sanitation

Centre for Environmental Research and Education (CERE)

Under the Water Conservation and Rainwater Harvesting Project, conducted

at the Police HQ in Naigaon, IndoStar Capital Finance Ltd contributed towards the augmentation

of water for the police family of the region. This project has yielded notable environmental and social outcomes:

- Harvesting 38.8 million litres of rainwater every year.

- Increase in groundwater table of the entire Naigon precinct area in Dadar.

- Recharge of defunct bore wells.

All the members of the police community have been enthusiastically involved in this project, being actively involved in CERE to complete it on time. The families were trained on the usage and saving of water, thus, helping a deserving section of society that is usually ignored.