Home » Farm Equipment

Farm Equipment

At IndoStar, we specialise in providing loans for the purchase of both new and used farm equipment. Farm equipment comprises of any equipment or machinery which enables a farmer or farm owner to conduct farming activities. Farm equipment may include tractor, attachments, seed-sowing machines, harvesters, sprinklers, etc.

Farm equipment loans provided by IndoStar can be availed by farmers and farm owners who need to purchase one or more than one machine for various agricultural activities such as ploughing, tilling, irrigating, seeding, etc. IndoStar’s Farm Equipment loans enables borrowers to purchase, upgrade or replace their equipment/machines easily and economically and repay the loan amount in Equated Monthly Instalments or EMIs.

Types of machinery falling under farm equipment loans:

Tractor

A tractor is the primary equipment used by a farmer or farm owner to work on his field and for load carrying. A tractor’s primary use is to enable farmers to optimally use other farm equipment like a harrow, tiller, plow, etc.

Sprayer

This kind of farm equipment is used to spray fertilizers, insecticides, pesticides, herbicides and any other product meant to sprayed on the soil or crops. Liquid or powdered products can be sprayed using this kind of machine.

Cultivator

Cultivators are used for cultivating the farm and making the soil softer for planting of crops.It can be used to get rid of weeds, aerate, make the soil softer.

Harvesters

As the name suggests this machine is used to harvest large amounts of crops in a relatively short time. Harvesters also minimise potential yield losses as these machines have been designed to handle crops gently. Harvesters also enable farmers to distribute straw or chaff evenly, which helps improve soil health, retain moisture and reduce soil erosion.

Harrows

Another machine which is used to cultivate the soil’s surface. It is utilised for deeper cultivation and helps farmers in preparing well-tilled seedbeds. Harrows also help in disrupting weed growth, thus helping crops receive more nutrients, water and sunlight.

Power Tillers

A tiller is a multi-purpose machine which helps farmers with ploughing, harrowing, levelling, weeding and seedbed preparation. Tillers can cover large areas in a short amount of time thus reduce labour and cost incurred in soil cultivation.

Features and Benefits:

- Get a loan for up to 100% of the vehicle cost*

- No additional security required

- Flexible payment options (online and offline)

- Large footprint across India with 350+ branches

- Loan available for both new and used farm equipment

- Long term up to 60 months

- Easy documentation, quick processing and faster disbursement

Eligibility and Documents Required

Any Indian resident or business entity

Individual need to be at least 21 years old

Proof of Identity

- PAN Card

- Passport

- Voter ID Card

- Driving License

- Govt. issued identity card

- Aadhar Card

Address Proof

- Passport

- Voter ID card

- Driving license

- Latest utility bills such as electricity bill, telephone bill, gas pipeline bill and water bill.

- Aadhaar card

- Ration card

The documents listed above are indicative and may vary based on the customer type.

Address Proof:

- Certificate under Shops and Establishment Act

- Certificate of registration

- Latest utility bills such as electricity bill, telephone bill, gas pipeline bill and water bill.

- Active bank account statement or passbook

- Property tax receipt

- Index II of property

- Registered rent agreement

- Certificate issued by professional body incorporated under relevant statute

Other KYC Documents

- Partnership firm: Partnership deed

- Company: Certificate of incorporation, Memorandum of Association, Articles of Association, latest CA-certified list of directors and shareholding pattern.

- Trust: Registration certificate and deed of trust

- Professionals: Qualifications and registration certificate

- Last 2 years audited CA-certified financials along with schedules, sub-schedules/tax audit report (if applicable), computation of income, ITR acknowledgement provisional financials (if applicable), along with VAT returns/GST returns to validate provisional sales figures

- Last 3 months salary slip along with their reflection in your bank account (in case of salaried individuals)

- Form 16 for last two years

- Last 6 months bank statements of all active bank accounts

- Last 6 months saving bank account of partners and directors (in case of partnership firm/company)

The documents listed above are indicative and may vary based on the customer type.

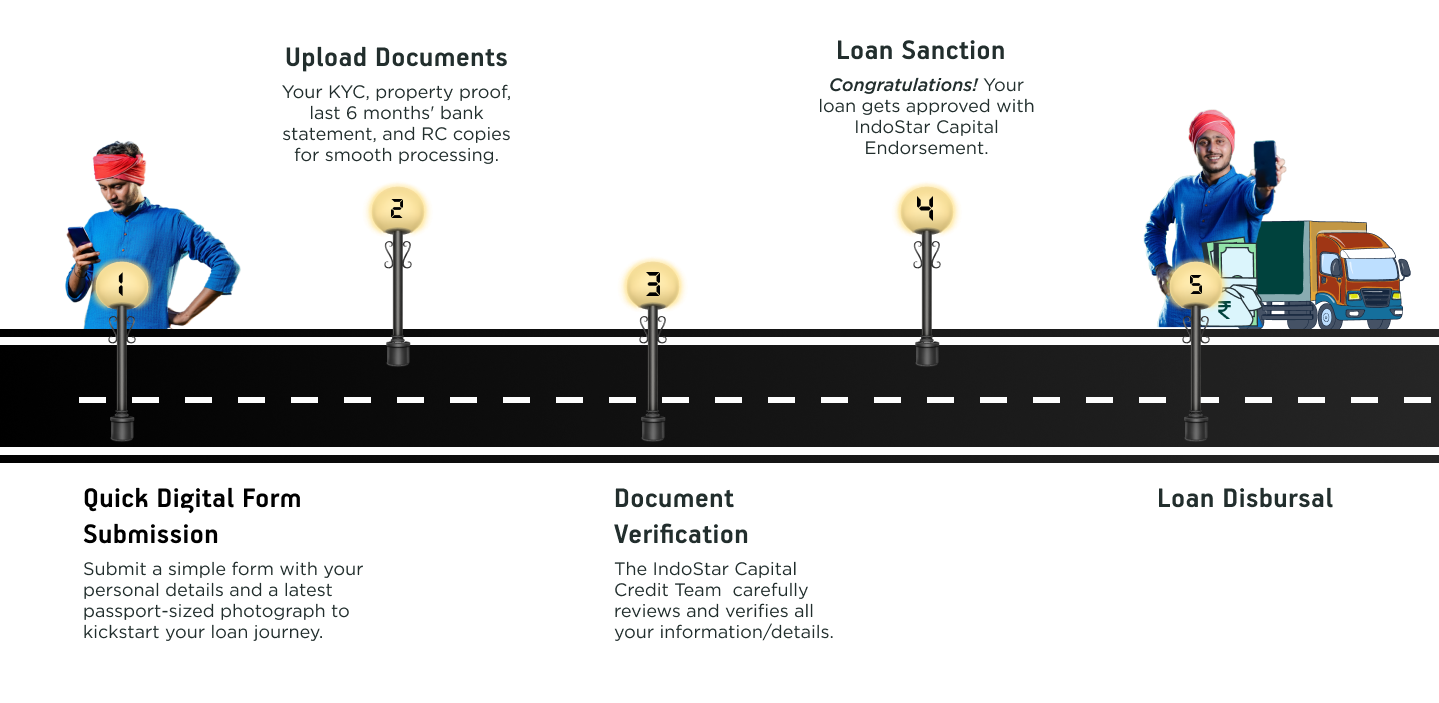

How To Apply For Loan

Interest rates and Fees:

Your farm equipment loan interest rate determines your EMI payments towards the loan repayment. At IndoStar, we offer loans at competitive interest rates, along with a flexible repayment tenure. Further, interest rates may vary for different borrowers depending on various eligibility factors like income, CIBIL score, loan disbursed, loan tenure, repayment capacity, financial history, and many more.

The interest rate for a commercial vehicle loan at IndoStar may range from 10% to 36% depending on eligibility calculations.

Fees structure can be taken from the current page: Interest Rates and Charges Policy