Home » Construction Equipment

Construction Equipment

Construction Equipment refers to the machinery required to develop and maintain the infrastructure of our country. The road/rail/air networks, connectivity, movement of raw materials/goods/people depends on how well developed is the country’s infrastructure. Availability of good Construction Equipment plays a vital role in this.

We at IndoStar Capital Finance, understand your requirements and specialise in providing Construction Equipment Loans which help you meet your business needs. With the government’s greater emphasis on developing infrastructure, we are able to service your requirements with an array of finance options which suit your requirements.

Construction equipment loans provided by IndoStar can be availed by individuals and corporates who are involved in businesses like excavation, mining, road building and construction. IndoStar’s Construction Equipment loans enable you to purchase, upgrade, or replace your construction equipment easily and economically.

Types of Construction Equipment

Earth Moving

These mainly comprise of Backhoe Loaders, Wheel Loaders, Crawler Excavators, Wheel Excavators and Dozers. They are used for clearing or removing of soil, rocks, trees, older structures etc.

Material Handling

Coming in after earth moving equipment are machines that help with the handling of construction materials and rubble. Examples include Cranes, Reach Stackers, Telehandlers, etc.

Concrete

This type of equipment is involved in the manufacturing and transportation of concrete used for various application from roads, building structures, factories, houses, etc. These include Batching Plants, Concrete Mixers, Crawler Excavators, Stationery Pumps, Mobile Line Pumps and boom Pumps.

Road Construction

These machines are generally involved in the development and maintenance of roads. These include – Pavers Tracked, Wheel Pavers, Soil Compactors, Batching Plants and Asphalt Finishers.

Features and Benefits:

- Get a loan for up to 100% of the equipment/vehicle cost*

- No additional security required

- Flexible payment options (online and offline)

- Large footprint across India with 350+ branches

- Loan available for both new and used commercial vehicles

- Long term up to 60 months

- Easy documentation, quick processing and faster disbursement

Eligibility and Documents Required

Any Indian resident or business entity

Individual need to be at least 21 years old

Proof of Identity

- PAN Card

- Passport

- Voter ID Card

- Driving License

- Govt. issued identity card

- Aadhar Card

Address Proof

- Passport

- Voter ID card

- Driving license

- Latest utility bills such as electricity bill, telephone bill, gas pipeline bill and water bill.

- Aadhaar card

- Ration card

The documents listed above are indicative and may vary based on the customer type.

Proof of Address:

- Certificate under Shops and Establishment Act

- Certificate of registration

- Latest utility bills such as electricity bill, telephone bill, gas pipeline bill and water bill.

- Active bank account statement or passbook

- Property tax receipt

- Index II of property

- Registered rent agreement

- Certificate issued by professional body incorporated under relevant statute

- Partnership firm: Partnership deed

- Company: Certificate of incorporation, Memorandum of Association, Articles of Association, latest CA-certified list of directors and shareholding pattern.

- Trust: Registration certificate and deed of trust

- Professionals: Qualifications and registration certificate

Proof of Income

- Last 2 years audited CA-certified financials along with schedules, sub-schedules/tax audit report (if applicable), computation of income, ITR acknowledgement provisional financials (if applicable), along with VAT returns/GST returns to validate provisional sales figures

- Last 3 months salary slip along with their reflection in your bank account (in case of salaried individuals)

- Form 16 for last two years

- Last 6 months bank statements of all active bank accounts

- Last 6 months saving bank account of partners and directors (in case of partnership firm/company)

The documents listed above are indicative and may vary based on the customer type.

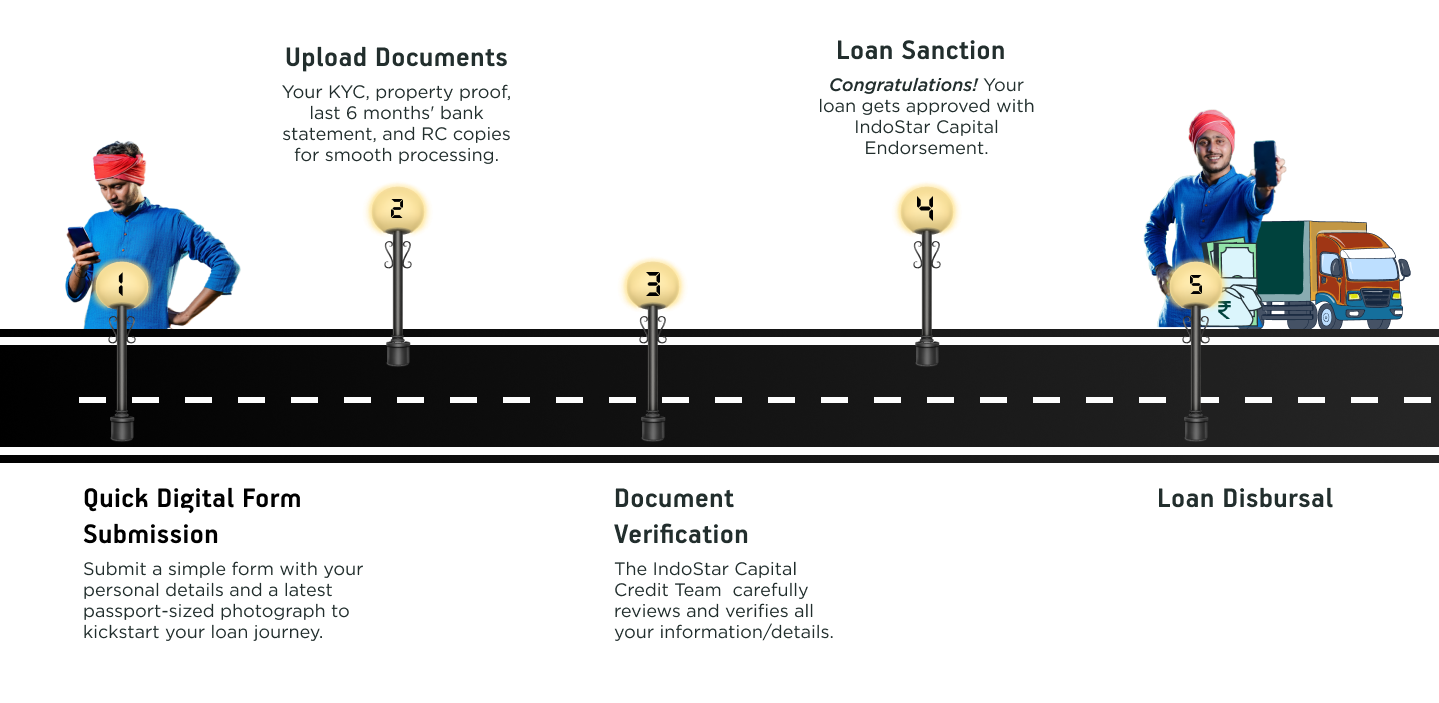

How To Apply For Loan

Interest rates and Fees:

Your construction equipment loan interest rate determines your EMI payments towards the loan repayment. At IndoStar, we offer loans at competitive interest rates, along with a flexible repayment tenure. Further, interest rates may vary for different borrowers depending on various eligibility factors like income, CIBIL score, loan disbursed, loan tenure, repayment capacity, financial history, and many more. The interest rate for a construction equipment loan at IndoStar may range from 10% to 36% depending on eligibility calculations.

Fees structure can be taken from the current page: Interest Rates and Charges Policy