Home » Car / MUV

Car / MUV

At IndoStar, we specialise in providing loans for the purchase of both new and used Cars and MUVs for personal and commercial uses. Cars comprise of vehicles of various size, shape and form and include hatchbacks, sedans, saloons and SUVs; whereas MUVs are usually larger in size compared to cars and are boxier and can carry higher number of passengers or goods. Pickups, vans and minivans are typically examples of MUVs. Cars and MUVs today run on a variety of fuels – Petrol Diesel, CNG and lately electricity

Car and MUV loans provided by IndoStar can be availed by individuals who need to purchase a car (hatchback, sedan and SUV) or MUV for personal or commercial use. IndoStar’s Car/MUV loans enables borrowers to purchase, upgrade or replace their existing vehicle easily and economically and repay the loan amount in Equated Monthly Instalments or EMIs.

Types of vehicles falling under Car and MUV:

Hatchback

A hatchback is typically defined as a small car that has two compartments: the engine and passenger. In India, it usually gets 5 doors with the fifth door being the rear hatch that lifts upwards to throw open a small boot compartment for storing luggage. Hatchbacks in India are usually of the sub 4 metre category.

Sedan

A sedan is a body style wherein a car has three distinct compartments for the engine, passengers, and the boot or truck. It can be distinguished from hatchbacks by the protruding trunk which can be opened up to storage luggage. In India, sedans can come in varying lengths ranging from lesser than 4 metres to ones larger than 4 metres.

SUVs

SUVs or Sports Utility Vehicles are large, boxy vehicles that usually have 5 doors and can seat between 5 to 7 people. With the recent preference towards SUVs, the category has been further divided into full-sized, compact and micro-SUVs.

MUVs

MUVs or Multi Utility Vehicles are typically used for commercial purposes (movement of goods and people) but can also be used for personal use. MUVs tend to be larger in overall size, with higher engine, seating and luggage capacity as compared to hatchbacks and sedans.

Features and Benefits:

- Get a loan for up to 100% of the vehicle cost*

- No additional security required

- Flexible payment options (online and offline)

- Large footprint across India with 350+ branches

- Loan available for both new and used vehicles

- Long term up to 60 months

- Easy documentation, quick processing and faster disbursement

Eligibility and Documents Required

Any Indian resident or business entity

Individual need to be at least 21 years old

Proof of Identity

- PAN Card

- Passport

- Voter ID Card

- Driving License

- Govt. issued identity card

- Aadhar Card

Address Proof

- Passport

- Voter ID card

- Driving license

- Latest utility bills such as electricity bill, telephone bill, gas pipeline bill and water bill.

- Aadhaar card

- Ration card

The documents listed above are indicative and may vary based on the customer type.

Address Proof:

- Certificate under Shops and Establishment Act

- Certificate of registration

- Latest utility bills such as electricity bill, telephone bill, gas pipeline bill and water bill.

- Active bank account statement or passbook

- Property tax receipt

- Index II of property

- Registered rent agreement

- Certificate issued by professional body incorporated under relevant statute

Other KYC Documents

- Partnership firm: Partnership deed

- Company: Certificate of incorporation, Memorandum of Association, Articles of Association,

- latest CA-certified list of directors and shareholding pattern.

- Trust: Registration certificate and deed of trust

- Professionals: Qualifications and registration certificate

- Last 2 years audited CA-certified financials along with schedules, sub-schedules/tax audit report (if applicable), computation of income, ITR acknowledgement provisional financials (if applicable), along with VAT returns/GST returns to validate provisional sales figures

- Last 3 months salary slip along with their reflection in your bank account (in case of salaried individuals)

- Form 16 for last two years

- Last 6 months bank statements of all active bank accounts

- Last 6 months saving bank account of partners and directors (in case of partnership firm/company)

The documents listed above are indicative and may vary based on the customer type.

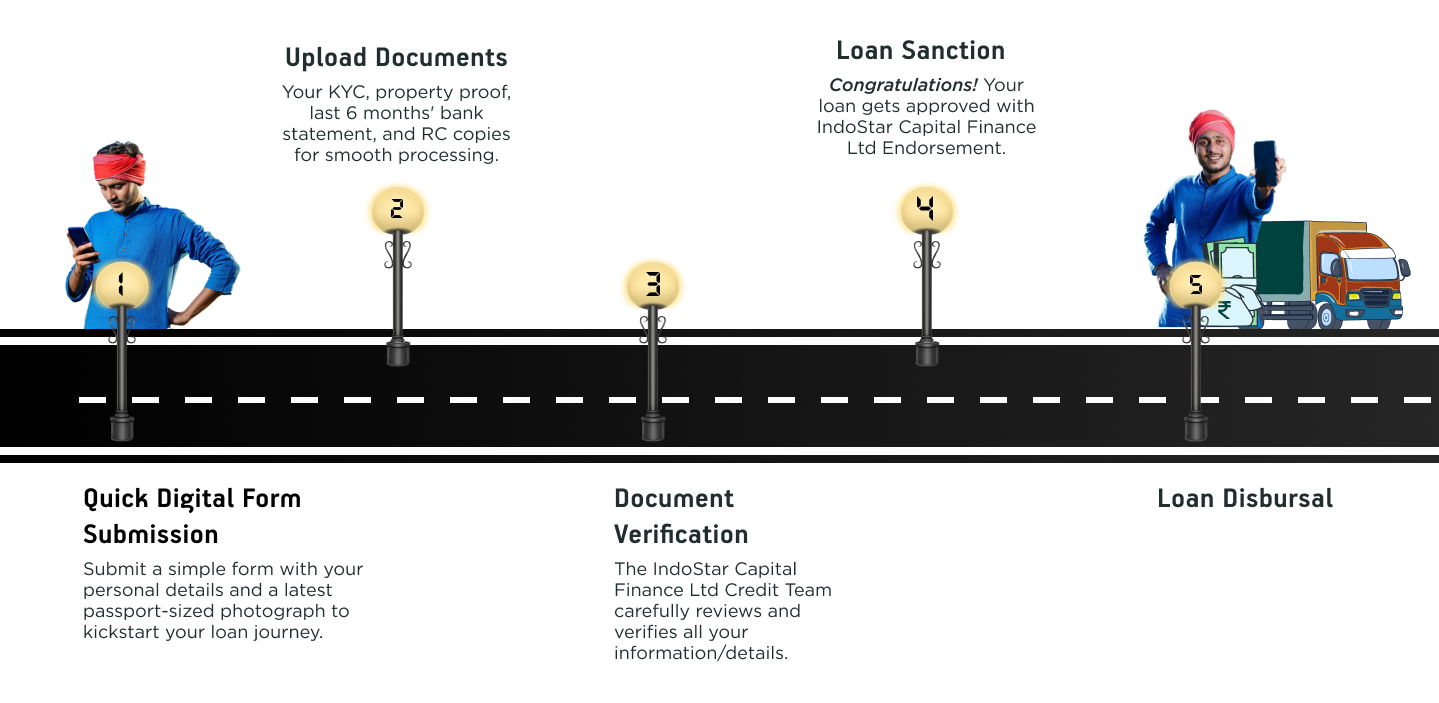

How To Apply For Loan

Interest rates and Fees*:

Your car loan interest rate determines your EMI payments towards the loan repayment. At IndoStar, we offer loans at competitive interest rates, along with a flexible repayment tenure. Further, interest rates may vary for different borrowers depending on various eligibility factors like income, CIBIL score, loan disbursed, loan tenure, repayment capacity, financial history, and many more. The interest rate for a vehicle loan at IndoStar may range from 10% to 36% depending on eligibility calculations.

Fees structure can be taken from the current page: Interest Rates and Charges Policy