Commercial Vehicle

At IndoStar, we provide commercial vehicle loans for purchasing both new and used commercial vehicles. These include vehicles such as buses, trucks, taxis, tempos, etc. We specialize in providing financial solutions to first time buyers/users (FTB OR FTU), fleet owners, small to medium enterprises and large corporates.

Types of Commercial Vehicles

MHCV – Medium and Heavy Commercial Vehicles

Know MoreVehicles with carrying capacity between 17 to 55 tons

ICV – Intermediate Commercial Vehicles

Know MoreThese comprise of vehicles that have a carrying capacity between 9 to 16 tons

LCV – Light Commercial Vehicles

Know MoreThe most popular category of commercial vehicle in India, these vehicles have a carrying capacity between 3 to 9 tons

SCV – Small Commercial Vehicles

Know MoreThese vehicles have a carrying capacity between 0.7 to 3.5 tons

Buses (Transport and School buses)

Know MoreAnother popular form of commercial vehicles are buses. The primary purpose is movement of passengers rather than goods and hence are categorised basis the number of seats, these usually range from 25 to 56 seats.

Features and Benefits:

Get a loan for up to 100% of the vehicle cost*

Loan available for both new and used commercial vehicles

No additional security required

Tenure up to 60 months

Flexible payment options (online and offline)

Easy documentation, quick processing and faster disbursement

Large footprint across India with 350+ branches

Eligibility norms

Any Indian resident or business entity

Individual need to be at least 21 years old

- Documents required for an individual

- Documents required for a Business

Proof of Identity

-

PAN card

-

Passport

-

Voter ID card

-

Driving license

-

Government identity card

-

Aadhaar card

Address Proof

-

Passport

-

Voter ID card

-

Driving license

-

Latest utility bills such as electricity bill, telephone bill, gas pipeline bill and water bill.

-

Aadhaar card

-

Ration card

The documents listed above are indicative and may vary based on the customer type.

Proof of Address

-

Certificate under Shops and Establishment Act

-

Certificate of registration

-

Latest utility bills such as electricity bill, telephone bill, gas pipeline bill and water bill.

-

Active bank account statement or passbook

-

Property tax receipt

-

Index II of property

-

Registered rent agreement

-

Certificate issued by professional body incorporated under relevant statute

Other KYC Documents

-

Partnership firm: Partnership deed

-

Company: Certificate of incorporation, Memorandum of Association, Articles of Association, latest CA-certified list of directors and shareholding pattern.

-

Trust: Registration certificate and deed of trust

-

Professionals: Qualifications and registration certificate

Proof of Income

-

Last 2 years audited CA-certified financials along with schedules, sub-schedules/tax audit report (if applicable), computation of income, ITR acknowledgement provisional financials (if applicable), along with VAT returns/GST returns to validate provisional sales figures

-

Last 3 months salary slip along with their reflection in your bank account (in case of salaried individuals)

-

Form 16 for last two years.

Banking

-

Last 6 months bank statements of all active bank accounts

-

Last 6 months saving bank account of partners and directors (in case of partnership firm/company)

The documents listed above are indicative and may vary based on the customer type.

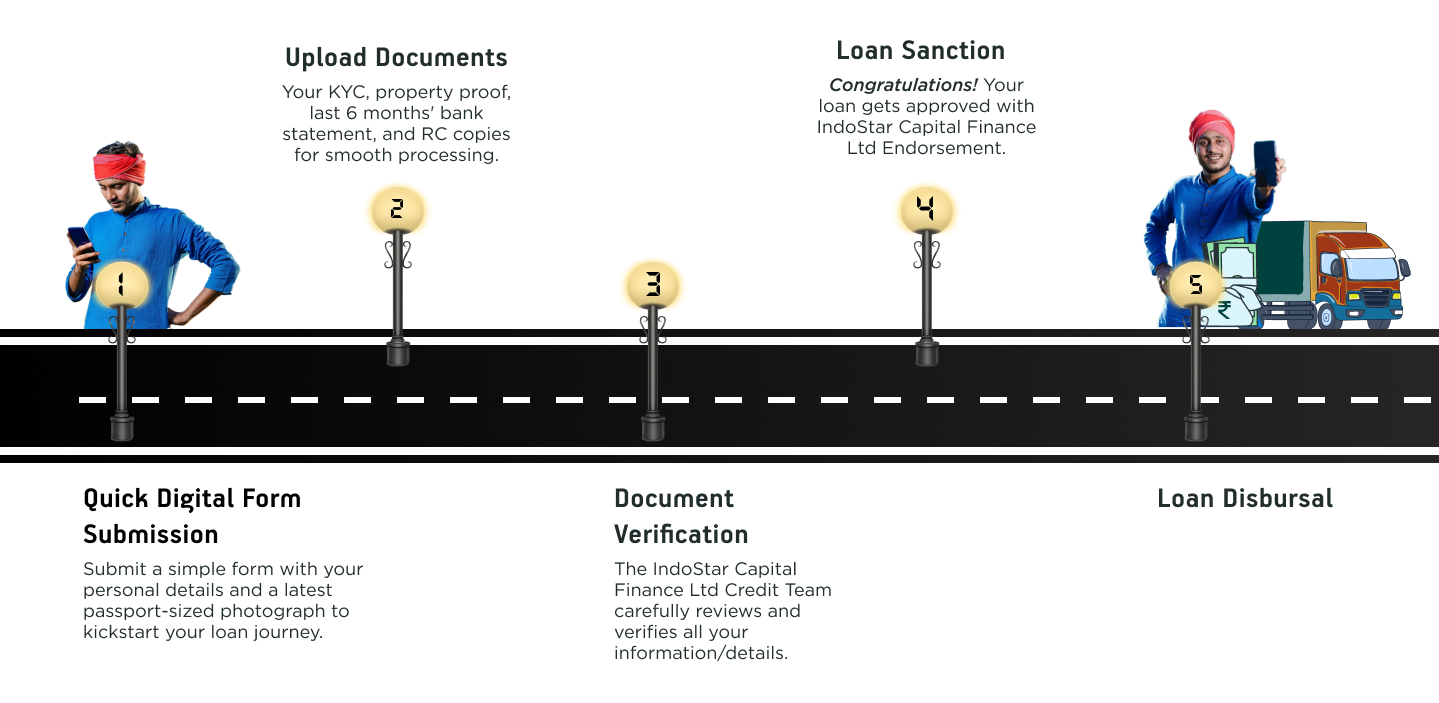

How To Apply For Loan

Interest rates and Fees:

At IndoStar, we offer Commercial Vehicle loans at competitive interest rates, along with a flexible repayment tenure. Further, interest rates may vary for different borrowers depending on various eligibility factors like income, CIBIL score, loan disbursed, loan tenure, repayment capacity, financial history, and more.

To refer our interest rate, charges and fees please refer: Interest Rates and Charges Policy